Better Financial Services for Employees & Retirees

Emergency loans and free financial tools for happier, healthier and more productive people.

You are more than your credit score

Emergency loans and free financial tools for happier, healthier and more productive people.

You are more than your credit score

Loans ranging from $500-$12,000 & terms from 6-48 months and rates from 19.99%-35.99%

You are more than your credit score

Loan offers in minutes from any device

Most borrowers get their loan proceeds deposited in their bank accounts instantly

If you are retired, share your retirement status you still may be eligible.

Tell us about yourself and provide required documentation if needed.

Sign your loan documents and get your money with same day funding available. 4

Apply regardless of your credit score

1 Loan amounts range from $500 to $12,000. Loan lengths range from 6 to 60 months. Annual Percentage

Rates (APRs) range from 19.99%-35.99%. Many loans have a one-time 5% origination fee. Loans do not

require repayment in full within 60 days from the loan issue date. For example, a $3,000 loan repaid in 52

biweekly installments of $76.00 over 24 months will have a 31.35% APR. Your loan’s details will depend on

the amount and your payroll schedule.

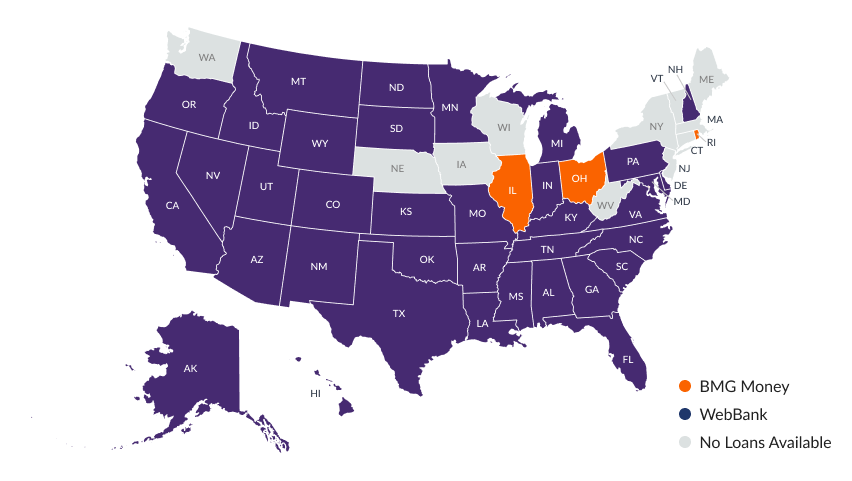

Most BMG Money-branded loans are made by WebBank. As of 08/01/2025, loans to residents of Illinois,

Ohio, and Rhode Island are made by BMG LoansAtWork, Inc.

BMG LoansAtWork, Inc. is licensed in many states. For more information, see https://www.bmgmoney.com/compliance.

Loans through BMG Money are provided at a significantly lower cost than most payday loans. According to

the Consumer Financial Protection Bureau, “A typical two-week payday loan with a $15 per $100 fee equates

to an annual percentage rate (APR) of almost 400%". Your actual loan's details will depend on the amount

and your payroll schedule.” Source: https://www.consumerfinance.gov/ask-cfpb/what-is-a-payday-loan-en-1567/

2 Your FICO Score will not be pulled or used for the processing of your loan application. Alternative credit scores are pulled and used in determining creditworthiness. We report payment history to all three major credit reporting agencies and failure to make payments may affect your credit scores.

3 A loan offer is not guaranteed. Terms subject to credit approval upon completion of an application. Loan sizes, interest rates, and loan terms vary based on the applicant’s credit profile. Loan terms are subject to verification of identity and credit information. Federal law requires financial institutions to obtain, verify, and record information that identifies each person who opens an account. We will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver’s license or other identifying documents.

4 If you provide a valid debit card linked to the bank account where your primary income is generally deposited, Instant Funding is available within minutes of signing for your loan. For applications approved and signed by noon ET, same-day ACH funding usually is available. For applications approved and signed by 4:30 pm ET or on Sundays and holidays, funds usually are deposited the next business day.