LoansAtWork

“Employees Financial Issues Affect Their Job Performance… Four out of five employers report that their employees’ personal financial issues are impacting their job performance…according to the IFEBP survey.”

SHRM (2016)“There’s a clear and meaningful correlation between employee engagement in their financial wellness benefit and retention... Financial Wellness programs have a direct impact on improved health and well-being, which leads to decreased stress levels, lower healthcare costs and more employees focused on their work!"

Benefits Pro (2022)

Skills & Knowledge

Access to Emergency Funds

All employees can enroll regardless of their credit score

Employers do not pay any fees whatsoever

No burden on the employer, our seamless solution integrates with all payroll systems to help manage payroll deduction

Over 11 years of excellent service

Employers do NOT have any risk or liability for any loans

Partner with us quickly and confindently

Free your employees from unnecessary misery and distress, add LoansAtWork to your benefits package. Enter your contact information below, we assure you a prompt response!

LoansAtWork3 provides access to short-term employment-based loans to employees in need.

1 Instant Funding available within minutes of signing for your loan if you provide a valid debit card linked to the bank account where your primary income is generally deposited. Same day ACH funding is available for applications approved and signed before 12:00 p.m. ET Monday - Saturday (not including federal holidays). For applications approved and signed by 4:30 p.m., funds are generally deposited the next business day Monday - Saturday (not including federal holidays, in which case funding will occur on the following business day).

2 Your FICO Score will not be pulled for the processing of this loan application; however, alternative credit scores are pulled and used in determining creditworthiness. LoansAtWork does not require any sort of credit score. Payment history is reported to all three major credit reporting agencies and failure to make payments may affect your credit scores.

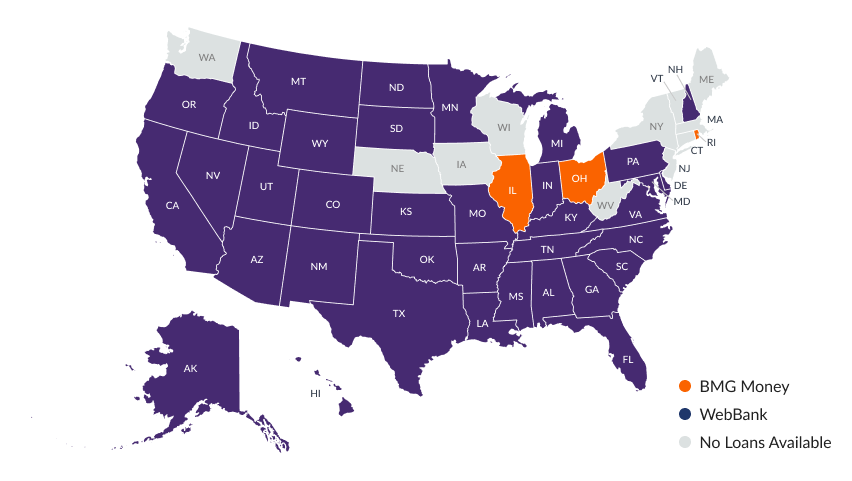

3 All loans marketed by BMG Money are made by WebBank, except, as of 12/08/2023 the loans made to residents of are made by BMG LoansAtWork, Inc.

4 Loans through BMG Money are provided at a significantly lower cost than most payday loans. For example, a $2,000 loan with a one-time fee of $59 will be paid through 87 installments over 40 months, will have an APR of 35.98% and the approximate biweekly payment will be $40.00 with a total payback amount of approximately $3,479.02 (assumes a loan execution date of 03/07/2024). In contrast, according to the Consumer Financial Protection Bureau, “A typical two-week payday loan with a $15 per $100 fee equates to an annual percentage rate (APR) of almost 400%.” Source: https://www.consumerfinance.gov/ask-cfpb/what-is-a-payday-loan-en-1567/

5 California Residents: California Privacy Rights: Our CCPA Notice can be found here: https://www.bmgmoney.com/california-consumer-privacy-notice/

6 Residents of Washington: BMG LoansAtWork, Inc. holds Consumer Loan Company License # CL1649032; NMLS Consumer Access webpage: www.nmlsconsumeraccess.org

7 The NEA Advantage Loan program is not available in Ohio, Maine, Nebraska, New York, Washington, West Virginia, New Hampshire, North Dakota, Georgia, Nevada, Rhode Island, Connecticut, Massachusetts, Vermont, Wisconsin, New Jersey.